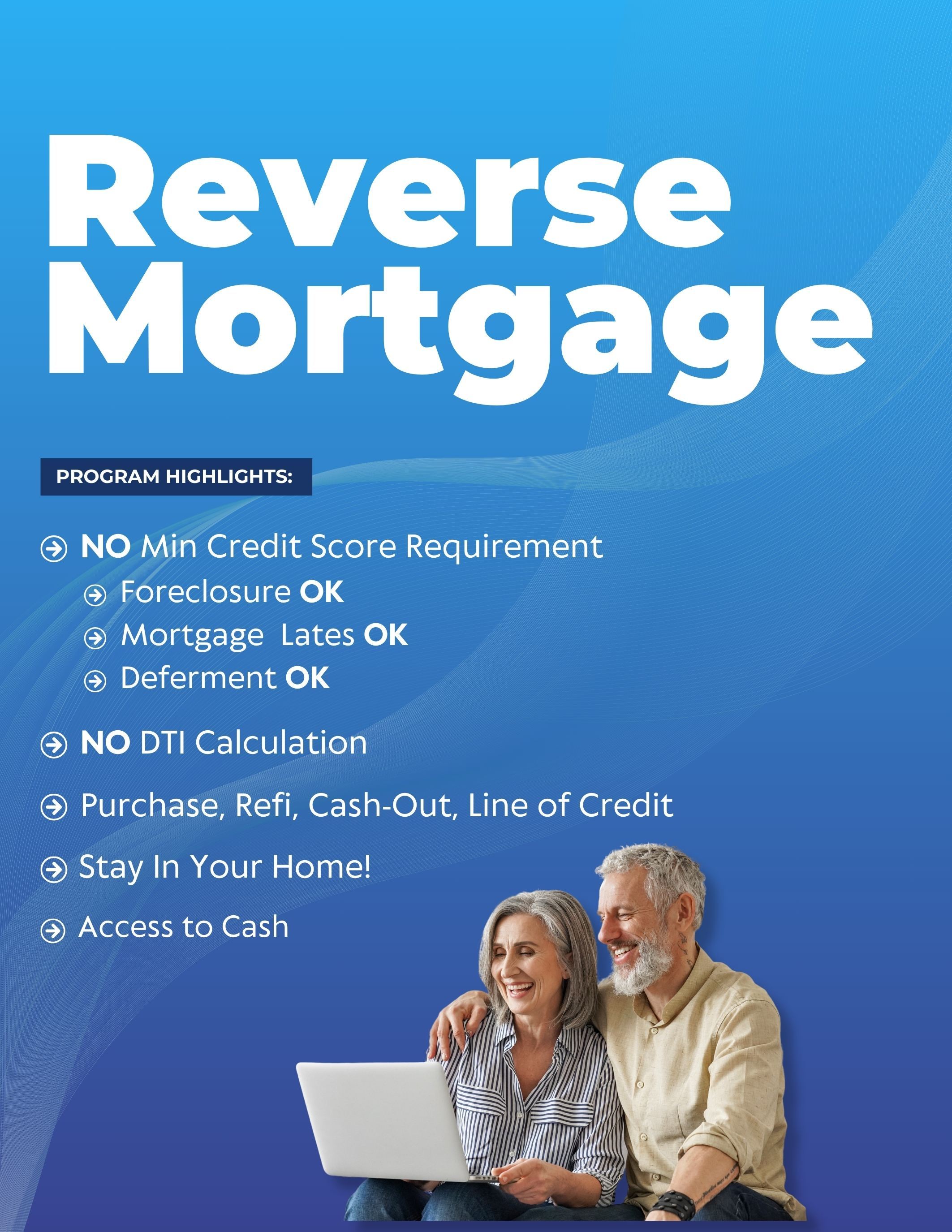

1. Access to Cash: It provides a way to convert home equity into tax-free cash, which can be used to cover daily living expenses, healthcare, or other needs.

2. No Monthly Mortgage Payments: Unlike traditional mortgages, you don't have to make monthly payments. The loan is repaid when you move out, sell the home, or pass away.

3. Stay in Your Home: You retain ownership of the home and can continue living there, as long as you meet loan terms (e.g., paying property taxes and insurance, maintaining the property).

4. Flexible Payout Options: Reverse mortgages offer various payment options, such as lump sum, monthly payments, or a line of credit.

5. Non-Recourse Loan: If the loan balance ends up exceeding your home's value when sold, you or your heirs aren't responsible for paying the difference. The lender absorbs the loss.

However, it's important to weigh these benefits against potential drawbacks, such as fees, interest accumulation, and the impact on your heirs. A financial advisor can help determine if a reverse mortgage is the right choice for your situation. Are you considering one, or just exploring options?